What is Critical Illness Insurance?

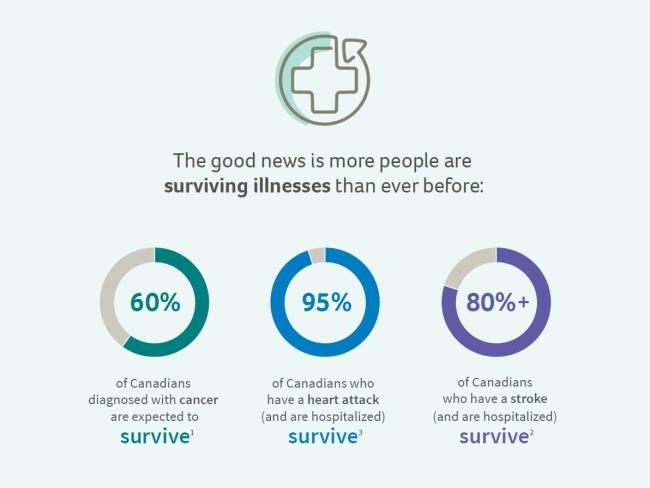

Planning ahead can ease the burden of a critical illness (CI). Unexpected health problems can throw your plans and goals off track. Getting sick can be expensive and not all bills will be covered by provincial health plans. Medical advancements mean more people survive illnesses than ever before, but recovery can be long and difficult. You can take steps now to help protect your family’s lifestyle and savings if you get sick later. If you’re faced with a serious illness and you have a plan, then you can focus on your recovery and worry less about money.

What is critical Illness Insurance?

A critical illness doesn’t have to derail your financial security plans and goals. Critical illness insurance issues a single lump-sum cash benefit should you be diagnosed with a critical illness that falls under the policy’s coverage; a common listing is below. CI coverage is not designed to be an ongoing benefit that covers lost income, but instead is to handle immediate needs or considerations while living with the illness. From paying for in-home care or to fast track your appointment with an international specialist, taking a once-in-a-lifetime trip, or renovating your home to meet new mobility needs, to paying debt obligations, you’re entirely free to use this money however you wish. The money is yours to do with as you please—no strings attached. You’ll have the flexibility to help keep your finances on track so you can focus on recovery.

Strategic Budgeting: A Key to Business Sustainability

CI insurance coverage varies according to the plan you select, but here is the common list of covered illnesses:

- Acquired brain injury

- Aortic surgery

- Aplastic anemia

- Bacterial meningitis

- Benign brain tumour

- Blindness

- Coma

- Coronary artery bypass surgery

- Deafness

- Dementia, including Alzheimer’s disease

- Heart attack

- Heart valve replacement or repair

- Kidney failure

- Life-threatening cancer

- Loss of limbs

- Loss of speech

- Major organ failure on waiting list

- Major organ transplant

- Motor neuron disease

- Multiple sclerosis

- Occupational HIV infection

- Paralysis

- Parkinson’s disease and specified atypical

- Parkinsonian disorders

- Severe burns

- Stroke

CI insurance can be included as part of your employment group benefits, albeit usually very minimal coverage, or as a stand-alone policy which can provide immense flexibility for you and your families needs. CI insurance is one way to protect against unmanageable expenses in the event of a serious illness. It’s not ongoing like disability insurance, but it can provide a much-needed infusion of cash at exactly the right time.

As financial planners, we do not provide specific tax and legal advice. You should always consult your accountant and/or lawyer where necessary. Because of the many ways a strategy may be impacted when segmented, we prefer to communicate collectively with your external professionals to ensure that all recommendations and action plans are in the overall best interest of you, with your professionals working with common goals in mind.

You are never obligated to act on our recommendations of products, services, or advice.