Trump’s Second Term: Key Policy Changes and Economic Implications

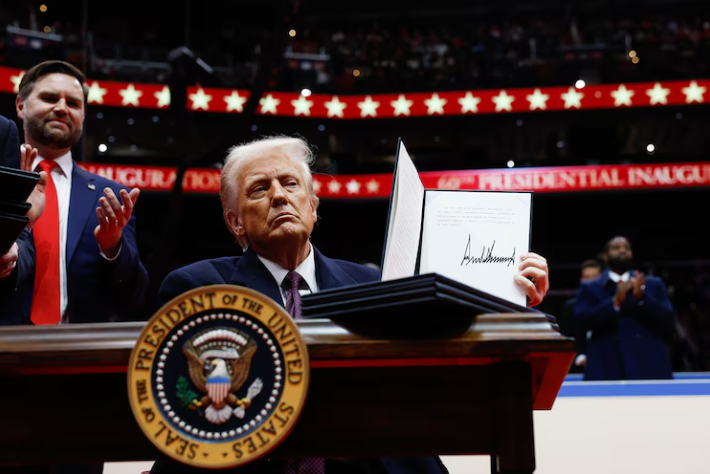

As Donald Trump begins his second term as President of the United States, he has laid out several ambitious policy changes that could impact both the U.S. and global economies. Here are the key takeaways from his inauguration:

Policy Shifts and Immediate Actions

Immigration and Border Security: Trump plans to strengthen U.S. border security, reinstate travel bans, and suspend refugee admissions. He will also expedite deportations for those convicted of crimes or who crossed the border illegally.

Energy and Climate: Trump aims to expand fossil fuel drilling on federal lands, roll back regulations put in place during the Biden administration, and reverse many of Biden’s climate policies, such as ending electric vehicle mandates and climate-related subsidies.

Regulatory Rollback: The Trump administration will focus on eliminating numerous federal regulations, particularly in areas like energy and the environment.

Pardons and Legal Issues: Trump has indicated the possibility of pardoning individuals involved in the January 6, 2021, Capitol riot.

Tariff Policies and Economic Impact

Tariffs have become a major focus under Trump’s leadership. He has proposed a blanket 10% tariff on all foreign goods and 25% tariffs specifically targeting China, Mexico, and Canada. While these tariffs are still in flux, their implementation could have significant economic consequences.

China: The U.S. plans to impose tariffs, although China’s economic output is less dependent on U.S. consumption, potentially reducing the impact.

Mexico and Canada: Trump is considering 25% tariffs on imports from these countries, which are intended to address issues like illegal immigration and drug trafficking. In response, both nations are already increasing security measures, but it’s unclear if these tariffs will come to fruition or remain in place long-term.

Global Economic Effects

While tariffs may raise costs and inflation, they are primarily seen as negotiating tools, and many believe their effects will be moderate, especially if other countries comply with Trump’s demands on trade, border security, and military spending. A potential slowdown in global growth and higher inflation in the U.S. could result, but a prolonged tariff war seems unlikely due to the economic harm it would cause all parties involved.

Looking Ahead

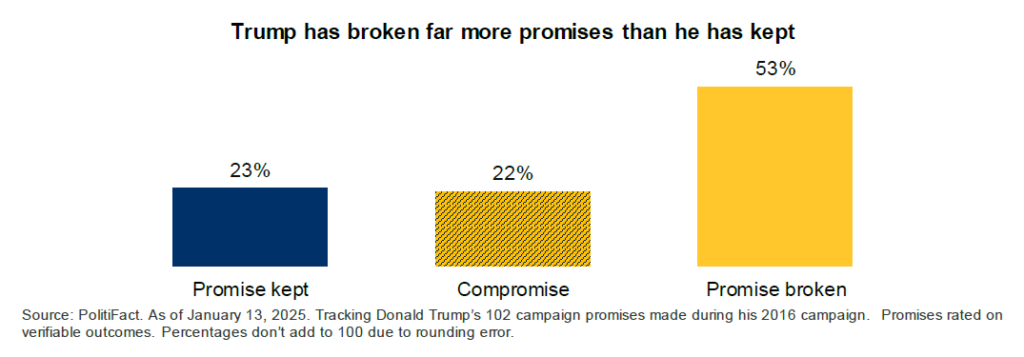

Despite Trump’s strong rhetoric, history suggests that not all of his campaign promises will be fully realized. In his first term, he implemented only 23% of his 2016 pledges, so it’s likely that his policies will evolve as political realities set in.

For businesses and investors, it’s important to stay informed as Trump’s administration works to implement these policies. While some changes could have immediate effects, others may unfold more gradually. The key will be monitoring how tariffs and other trade policies evolve and adjusting strategies accordingly.

As financial planners, we do not provide specific tax and legal advice. You should always consult your accountant and/or lawyer where necessary. Because of the many ways a strategy may be impacted when segmented, we prefer to communicate collectively with your external professionals to ensure that all recommendations and action plans are in the overall best interest of you, with your professionals working with common goals in mind.

You are never obligated to act on our recommendations of products, services, or advice.