What is Permanent Whole Life Insurance?

No one likes to consider their own mortality, but having a plan is the best way to ensure the loved ones you leave behind are financially protected. Knowing your options when it comes to life insurance is an integral part of that planning process. Read on to learn what you need to know about whole life insurance, one of the most common types of life insurance in Canada.

What is whole life insurance?

Whole life insurance provides lifelong coverage at a fixed premium, meaning your insurance payments never change no matter your age, and is in force as long as you are alive and premiums are paid.

Within the whole life insurance offering, there are a few different types of coverage you can consider.

Permanent Participating Insurance

Over time, your participating life insurance policy builds cash value. Cash value is built up by dividends paid into the policy by the insurance carrier each year. You have guaranteed access to these funds, which you can use in many ways during your lifetime. Your policy’s cash value grows tax-free while inside the policy, subject to government limits.

You can use dividends in one of many ways:

You can buy additional insurance coverage, which may increase your cash value further.

You can reduce (or even stop) premium payments.

You can take your dividends as cash.

You can borrow, with interest, backed by your policy’s cash value and eventually pay it back.

When you die, any dividends and cash value remaining within the policy can be paid out tax free to your beneficiaries in addition to the base coverage amount initially applied for.

Permanent Participating Insurance

Over time, your participating life insurance policy builds cash value. Cash value is built up by dividends paid into the policy by the insurance carrier each year. You have guaranteed access to these funds, which you can use in many ways during your lifetime. Your policy’s cash value grows tax-free while inside the policy, subject to government limits.

You can use dividends in one of many ways:

You can buy additional insurance coverage, which may increase your cash value further.

You can reduce (or even stop) premium payments.

You can take your dividends as cash.

You can borrow, with interest, backed by your policy’s cash value and eventually pay it back.

When you die, any dividends and cash value remaining within the policy can be paid out tax free to your beneficiaries in addition to the base coverage amount initially applied for.

How it works:

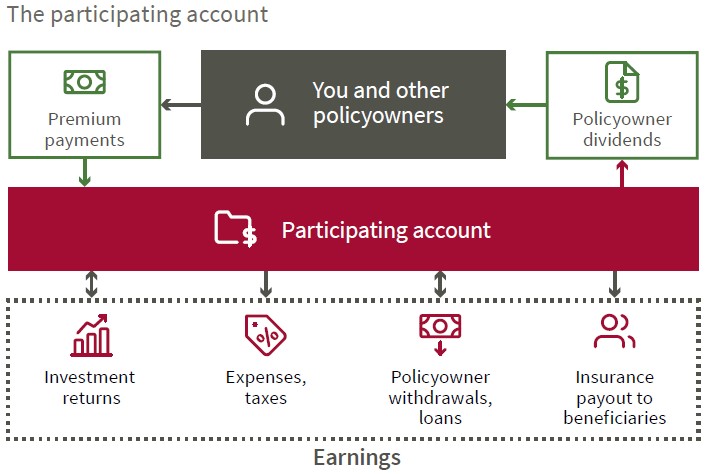

Your insurance payments, together with the insurance payments from all other participating policyowners with the carrier, go into the participating account. The insurance company manages this account to meet the guarantees and commitments to all participating life insurance policyowners, now and in the future.

If actual performance is better than the assumptions at the time of initial pricing, which may include but isn’t limited to investments, expenses and taxes, policyowner withdrawals and loans and payouts, earnings are generated for the participating account.

When earnings exceed the amount needed to meet guarantees and commitments policyowners might be able to share, or “participate,” in these earnings. Carriers might distribute some of these earnings as policyowner dividends, although this isn’t guaranteed.

Universal Life Insurance

Universal life insurance can be flexible, affordable and last a lifetime. And that’s not all: it lets you invest and potentially grow your money over time.

You get permanent protection that’s guaranteed to last a lifetime, as long as you pay your insurance premium.

Want a hands-off policy you don’t have to keep tabs on? Or do you want customized coverage you can actively manage? With universal life insurance, you choose what works best for you.

How it works

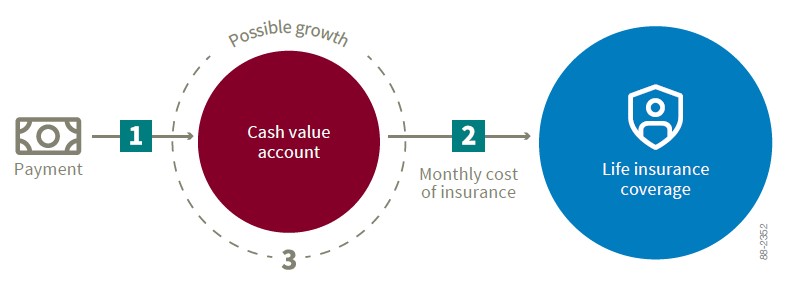

When you make an insurance payment (called a premium), it goes into your policy’s cash value account.

To pay for your policy, the insurance carrier deducts what’s called cost of insurance from that account.

If there’s money left over in the account afterward, it’s automatically invested based on your investment fund choices and risk tolerance.

Over time, your account’s value may grow. And if your investments perform well and/or you decide to put extra money into your policy, it may grow even faster. This money is available while you’re alive for whatever you want.

You can also use money left over in your account to cover your cost of insurance

There is so much more to know about these types of whole life insurance. Make your first call to Statera Financial Planners and let them provide you with the simple language to explain everything there is to know before you begin your insurance considerations!

As financial planners, we do not provide specific tax and legal advice. You should always consult your accountant and/or lawyer where necessary. Because of the many ways a strategy may be impacted when segmented, we prefer to communicate collectively with your external professionals to ensure that all recommendations and action plans are in the overall best interest of you, with your professionals working with common goals in mind.

You are never obligated to act on our recommendations of products, services, or advice.