Why We Focus More on Downside Protection, Than Upside Return Capture

Every investor wants strong returns with little or no risk, however it is not a realistic expectation for the long term to be able to achieve both benefits at the same time. There’s a saying “a high tide lifts all boats”, and we feel this is true of bull market runs, everyone can capture some growth quite easily when everything is doing well.

Historically, 72% of the time the markets have advanced positively, meaning we don’t have to be perfectly right all the time to attract positive movements. However, it’s protecting the 28% of downward bear markets better than average that provides a true advantage and is the focus of our firm’s philosophy.

We, along with portfolio managers, are always managing the risks we know about and can predict, therefore by default it is the unexpected risks that can cause wealth destruction. No one could have predicted the market events of 2020, and while a pandemic is certainly rare, history is rife with declines caused by panic over wars and recessions preceded by burst bubbles, banking, and housing crises… the reasons vary.

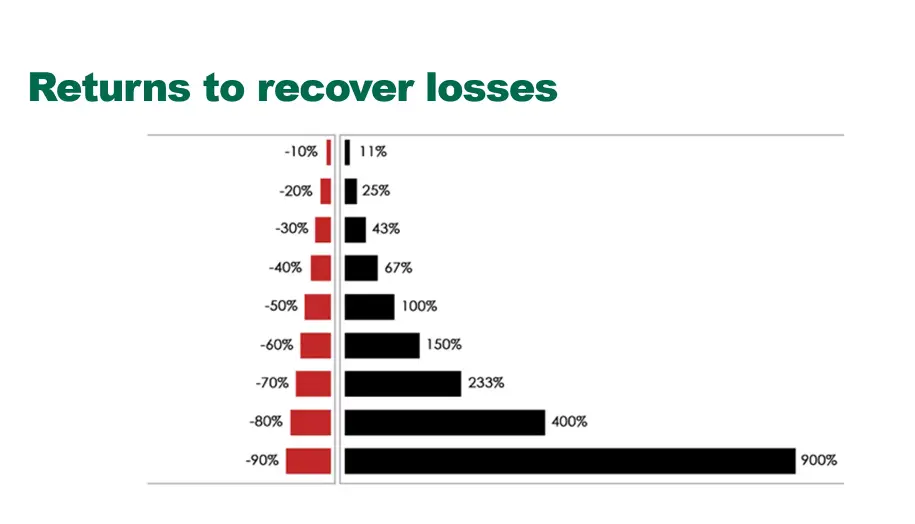

Because of this, we believe it is wise to incorporate downside protection strategies when constructing a portfolio. These strategies can hedge the losses that may occur with substantial market declines. Why does this matter? Because big losses require even bigger recoveries to return to the break-even point. The key here: if your portfolio needs to recover from a loss, it’s not compounding wealth.

It's inevitable that there will come a time when your principal investment shrinks. Depending on your age, your needs or those of your family, you don’t always have the time it takes to recover from a substantial loss; yet another reason to consider drawdown protection. It's important for you and for us to remember that your timeline doesn’t change.

So, if we can protect against the same drawdown experience, in a way that can be easily recoverable regardless of your life stage, then we feel that is important and beneficial for all!

As financial planners, we do not provide specific tax and legal advice. You should always consult your accountant and/or lawyer where necessary. Because of the many ways a strategy may be impacted when segmented, we prefer to communicate collectively with your external professionals to ensure that all recommendations and action plans are in the overall best interest of you, with your professionals working with common goals in mind.

You are never obligated to act on our recommendations of products, services, or advice.