What To Expect From The Financial Planning Process

What To Expect From The Financial Planning Process

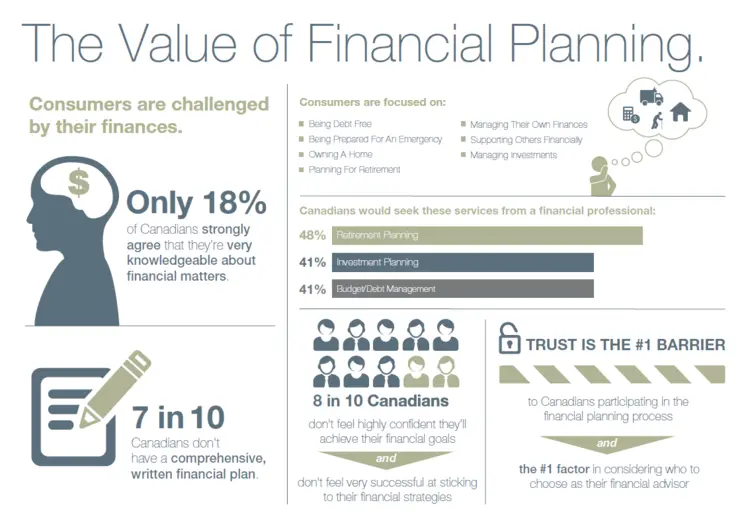

Financial planning is a broad, comprehensive process. It’s this big picture approach that sets qualified CFP professionals, like us at Statera Financial Planners, apart from all other financial advisors who may have been trained to focus only on one aspect of your finances and therefore by default have a more narrow view to the considerations of your financial well-being.

A good financial plan considers all aspects of your life and finances, balancing what you need and want today with the personal goals you have for the future. What can you expect from the financial planning process in general?

ESTABLISHING THE ENGAGEMENT

Your planner should:

- Explain the overall financial planning process and the concepts and/or concerns that are applicable.

- Explain the requirement of documentation and the use of that documentation with the planning process.

- Clarify your responsibilities as a client.

- Clarify their responsibilities as your planner, including a discussion about their compensation for your consideration.

Together, you should:

- Discuss the scope of the client/planner engagement, what services will be included with the plan, and how the delegation of action plans will be done.

DETERMINING YOUR GOALS AND EXPECTATIONS

Your planner should:

- Make every effort to understand your life goals and how your finances can impact those goals.

- Obtain information about your financial resources and obligations through interviews or questionnaires.

- Gather all necessary information and documents before giving you any advice.

Together, you should:

- Define your personal and financial goals, needs and priorities.

- Investigate your values, preferences, financial outlook, and desired results as they relate to your financial goals, needs and priorities.

CLARIFYING YOUR CURRENT FINANCIAL STATUS AND IDENTIFYING PROBLEMS AND OPPORTUNITIES

Your planner should:

- Analyze your information to assess your current situation (including cash flow, net worth and tax projections)

- Identify any problem areas or opportunities with respect to your:

- Capital needs

- Risk management needs and coverage

- Investments

- Taxation

- Retirement planning

- Employee benefits

- Estate planning

- Special needs (i.e. adult dependent needs, education needs, etc.)

DEVELOPING AND PRESENTING THE FINANCIAL PLAN

Your planner should:

- Develop and prepare a financial plan tailored to meet your goals and objectives, values, and risk tolerance, while providing projections and recommendations

- Present the plan to you

- Establish an appropriate review cycle

Together, you should:

- Work to ensure that the plan meets your goals and objectives

- Assist you in implementing the recommendations discussed (if that's what you want). This may involve coordinating contacts with other professionals such as accountants, lawyers or psychologists.

IMPLEMENTING THE FINANCIAL PLAN

Your planner should:

- Periodically contact you to review the progress of the plan and make necessary adjustments to the recommendations to help you achieve your goals. This review should include:

- A review and evaluation of the impact of changing tax laws and economic circumstances

- A review of your life circumstances, and an adjustment of the recommendations if necessary. Circumstances often change through life events such as a birth, death, illness, marriage, or retirement.

- Updating financial details and how that impacts the planning outcomes.

Statera Financial Planners has a very in depth financial planning process, with additional steps and guidance to help in the success of your financial wellbeing. We will monitor and evaluate whether your plan is helping you progress toward your goals, but more so we will also keep you accountable to the action plans discussed and agreed upon. We want to ensure we have done everything in our control to help get you to a place of mindful peace around your finances; working with you as a team we know there is value in this process. Let us show you how we can bring that value to your life!

A good financial plan considers all aspects of your life and finances, balancing what you need and want today with the personal goals you have for the future. What can you expect from the financial planning process in general?

As financial planners, we do not provide specific tax and legal advice. You should always consult your accountant and/or lawyer where necessary. Because of the many ways a strategy may be impacted when segmented, we prefer to communicate collectively with your external professionals to ensure that all recommendations and action plans are in the overall best interest of you, with your professionals working with common goals in mind.

You are never obligated to act on our recommendations of products, services, or advice.